In a significant move, the Reserve Bank of India (RBI) has set up a dedicated panel to develop an Artificial Intelligence (AI) framework for fintech companies. This decision supports RBI’s efforts to ensure that the fintech industry evolves securely, efficiently, and innovatively. As a result, RBI aims to foster a sustainable, tech-enabled financial ecosystem by integrating emerging technologies, such as AI, into India’s financial fabric.

The Need for an AI Framework in Fintech

India’s fintech sector is growing rapidly. Startups and established companies are revolutionizing financial services, from digital payments to lending, wealth management, and insurance. Consequently, fintechs are reshaping traditional banking. RBI recognizes the need for a structured framework as these companies grow and adopt advanced technologies. AI in fintech can improve customer service, streamline operations, and enhance decision-making. However, it also raises concerns about security, privacy, and fairness. Thus, the RBI’s AI framework addresses these issues while promoting innovation.

The Role of the Panel

The panel will consist of experts from both the financial and technology sectors. Its primary task will be to design guidelines and regulatory measures to help fintech companies responsibly adopt AI technologies. RBI will oversee the process to ensure that the recommendations create a regulatory environment that enables innovation without compromising security or fairness.

The panel will focus on several key areas:

- Data Privacy and Security: AI-driven services handle large amounts of data. Therefore, fintech companies must adopt best practices for protecting customer data, including securing data, preventing cyberattacks, and complying with data protection laws.

- Ethical Use of AI: Since AI systems often rely on autonomous decision-making, the panel will create guidelines to prevent bias, ensure fairness, and protect consumers from discrimination.

- Regulation and Compliance: As AI technology evolves, it may outpace existing regulations. The panel will ensure that fintech companies comply with national and international standards while embracing AI opportunities.

- Encouraging Innovation: Regulation is necessary, but it must also allow fintechs the flexibility to innovate. Therefore, the panel will create an environment for AI-driven innovation, which will fuel the growth of India’s fintech ecosystem.

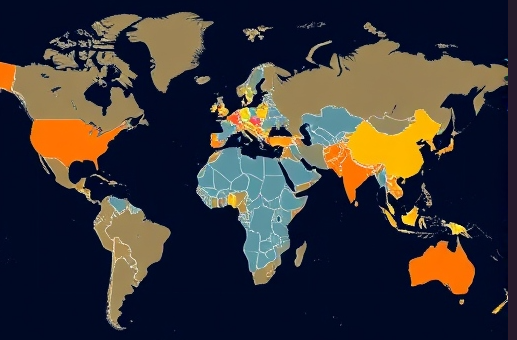

This map visually represents the global landscape of AI and FinTech, highlighting the growing importance of these sectors worldwide. The Indian flag and the mention of Mital’s firms in India suggest that the image aims to emphasize the potential impact of AI and FinTech developments in India, particularly in light of the RBI’s initiative to establish an AI framework for fintechs.

Potential Impact on the Fintech Ecosystem

RBI’s decision to create an AI framework for fintech could transform the industry. By providing clear guidelines, RBI will help fintechs manage risks and fully benefit from AI technologies. This framework will also build trust between consumers and fintech platforms, which is crucial for scaling AI-driven services. Furthermore, the creation of this panel will likely attract more investment in fintech. A structured AI framework signals maturity and readiness for sustainable growth in India’s fintech sector.

A Step Toward Financial Inclusion

AI has the potential to drive financial inclusion in India. By integrating AI tools into products like micro-loans, digital payments, and credit scoring, fintechs can reach underserved populations. Moreover, RBI’s AI framework will ensure that these technologies support inclusion while protecting vulnerable consumers. Additionally, AI can lower the cost of financial services, making them more accessible. From better risk assessments in lending to more efficient insurance claims processing, AI can make financial services more affordable and available across India.

Challenges and Way Forward

While the panel’s establishment is a significant step, challenges remain. One key hurdle is balancing innovation with regulation. Too much regulation may stifle innovation, while too little could lead to AI misuse. Therefore, the panel must find the right balance for success. As the AI ecosystem evolves, the panel will need to review and update the framework regularly. This will require close collaboration with global experts, fintech companies, and regulatory bodies.

Conclusion

RBI’s creation of an AI framework for fintech marks a turning point for India’s fintech industry. As AI plays a bigger role in financial services, a clear framework ensures responsible and ethical use. This framework will drive growth and financial inclusion as fintech companies innovate and expand. RBI’s decision signals a future where AI enhances financial services, benefiting both the industry and consumers.

In the coming years, it will be fascinating to see how this framework shapes India’s fintech ecosystem and influences global trends. RBI’s proactive steps may serve as a model for other countries regulating AI in fintech while fostering innovation.